Trust Tax Returns Required by the IRS

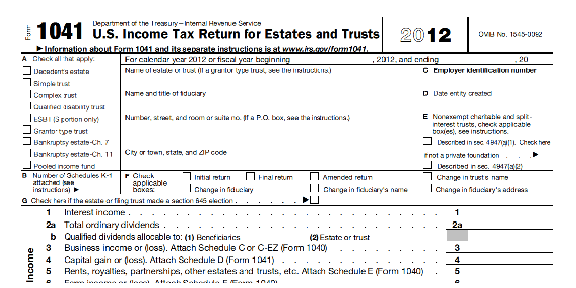

Although some trusts might save some money on taxes, they do NOT eliminate taxes. While individuals pay income tax on a form 1040, Trusts pay on form 1041 "Fiduciary Return."

After a grantor passes away, a taxable estate must file a form 706 which is a tax on the net assets of the estate. This is a very complicated tax return that most CPAs do NOT do, particularly on second to die situations.

If you have questions regarding these tax forms, give Michael Perdue a call for a free, no obligation consultation.

You can get free copies of these tax forms here:

These documents are quite complicated and there can be severe penalties from the IRS if they are not done properly. Call us if you need assistance.